Scraprice.com News

The price of gold has increased: what to choose: buy or is it better to sell?

2025-06-05, Scrap Gold prices

Since the beginning of 2025, the price of gold in the world has increased by about 20-30%, which has directly affected the purchase prices. If you have unused jewelry, now may be a good time to sell it, as buyers are offering much higher prices than a few months ago.

What are the current purchase prices for gold?

Based on scraprice.com data on gold purchase prices we present the prices of gold buyers in €/gr for 585 fineness (14 carat) gold from several countries:

(country, buyer, price, price fixing date)

USA (Cash for Gold USA) – €56.32/g (2025.05.08)

Czech Republic (Profihotovost) – €53.064/g (2025.06.02)

Poland (Artar S.C.) – €53.44/g (2025.05.11)

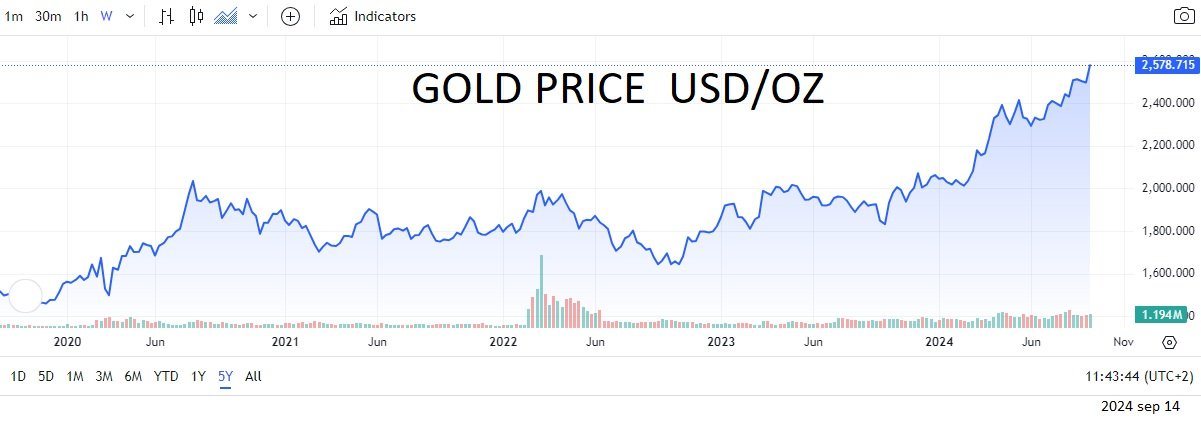

Gold Price Reaches a New Record

2024-09-14, Scrap Gold prices

14 September 2024 has gone down in history as an important day in the gold market. On this day, the price of gold reached an all-time high of USD 2,580 per ounce. This event is undoubtedly pleasing for both gold investors and sellers, who can now look forward to greater financial gains.

Why has the Gold Price Risen?

There are several reasons for the rise in gold prices. Firstly, global economic turmoil and geopolitical strife often increase the demand for precious metals such as gold, which are considered a safe haven for investors. Secondly, global financial market volatility and fears of inflation can also contribute to the rise in gold prices.

Where to Sell Gold Most Expensive?

Read moreThe price of gold decreased slightly at the beginning of 2024

2024-01-05, Scrap Gold prices

At the beginning of 2024, the price of gold surprised again with a negative change. During the first few days of this year, the price of gold fell by 2% and on January 3rd. was down almost to $2,032 per ounce.

By the end of December 2023, the price of gold had reached more than 2,088 US dollars per ounce. It seems that a record price of gold has been reached. However, such a jump in the price of gold was instantaneous and the price later returned to its previous level. Hardly anyone could name the specific reason for such a price jump, because the price of gold is influenced by many factors, starting with the markets of individual countries and ending with the geopolitical situation. There will be different opinions, but it's probably more than just speculation. The price of gold has remained

1 - 3 / 12

1 - 3 / 12